Article Focus Summary

China’s insecticide exports soared in April 2025, with shipments up over 40% year-on-year. Key buyers included Brazil, Thailand, and Myanmar, highlighting China’s dominant role in supplying pest control formulations amid shifting global pricing dynamics.

April 2025 Insecticide Export Overview

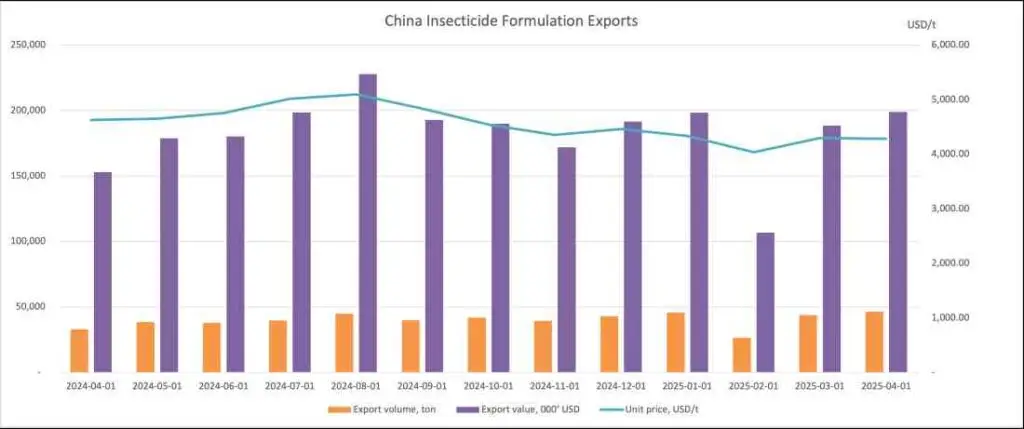

According to newly released data from the General Administration of Customs of China (GACC), insecticide formulation exports surged in April 2025:

- Total volume: 46,433 tons, up 40.49% YoY

- Export value: US $198.77 million, up 29.97% YoY

- Average export price: US $4,280.78 per ton, a 7.49% decline YoY

This highlights an aggressive increase in shipment volume despite pricing pressures, suggesting strong global demand for pest management products, particularly in tropical and subtropical farming regions.

Export Destinations and Market Dynamics

In April, China exported insecticides to 139 countries and regions. The top three markets by volume were:

Brazil

- Export volume: 6,096 tons (+43.99% YoY)

- Export value: +58.56% YoY

- Average price per ton: +9.31% YoY

Brazil continues to dominate China’s insecticide export market. The price increase points to premium formulations for soybeans, cotton, and sugarcane crops facing heavy pest pressure.

Thailand

- Export volume: 3,447 tons (+39.99% YoY)

- Export value: +48.95% YoY

- Average price per ton: +6.40% YoY

Thailand’s increase in both volume and pricing reflects regional demand for rice- and fruit-oriented pest solutions as planting season peaks.

Myanmar

- Export volume: 3,369 tons (+83.79% YoY)

- Export value: +73.32% YoY

- Average price per ton: −5.64% YoY

Myanmar posted the sharpest growth in export volume but saw a decline in average pricing, indicating purchases of more generic or low-cost broad-spectrum insecticides.

January–April 2025 Aggregate Export Performance

Between January and April 2025, China’s insecticide formulation exports totaled:

- Volume: 162,513 tons

- Export value: US $692.13 million

- Average price: US $4,235.67 per ton

Compared to previous periods, this represents a strong quarterly export position with rising cumulative volumes, even amid softening unit prices.

Market Trends and Strategic Insights

1. Global Pest Pressure Drives Demand

The broad-based export increase reflects heightened pest pressure globally, particularly in warmer climates where invasive insects and pesticide resistance remain persistent challenges.

2. Diversified Product Demand

While some regions—like Brazil—opt for advanced formulations, others—like Myanmar—focus on affordability. This allows Chinese exporters to segment markets by value and volume.

3. Formulation Adaptation

China’s ability to customize formulations, such as emulsifiable concentrates (ECs), suspension concentrates (SCs), and water-dispersible granules (WDGs), enables better alignment with local application preferences and climatic needs.

Competitive Landscape and Key Players

Prominent Chinese exporters such as Jiangsu Changqing Agrochemical, Hubei Sanonda (ADAMA China), and KingAgroot have expanded their formulation capabilities to meet global MRL standards and rising regulatory compliance.

These firms are focusing on:

- Synergized dual-action insecticides

- Sustainable, low-toxicity options for sensitive crops

- Resistance management protocols

Export success is also tied to strategic warehousing and distribution hubs in Latin America and Southeast Asia.

Export Market Implications

- Brazil: Likely to maintain or increase imports as soybean expansion continues in Mato Grosso and surrounding regions

- Thailand: Seasonal rice crop cycles and fruit orchard pest protection drive continued demand

- Myanmar: Subsidized agriculture programs may support high-volume but lower-value imports

Despite falling average prices overall, the increased export volumes signal robust trade health and resilient global agricultural demand.

April 2025 Key Export Metrics Summary

| Metric | April 2024 | April 2025 | YoY Change |

|---|---|---|---|

| Volume (tons) | ~33,050 | 46,433 | +40.49% |

| Value (US$) | ~$152.8 million | $198.77 million | +29.97% |

| Avg Price (US$/ton) | ~$4,625 | $4,280.78 | −7.49% |