Article Focus Summary

China’s herbicide formulation exports climbed sharply in April 2025, driven by surging demand in Brazil and steady growth in Thailand and Nigeria. The volume and value increases signal robust overseas market reliance on Chinese agrochemicals, despite regional price fluctuations.

April 2025 Herbicide Export Highlights

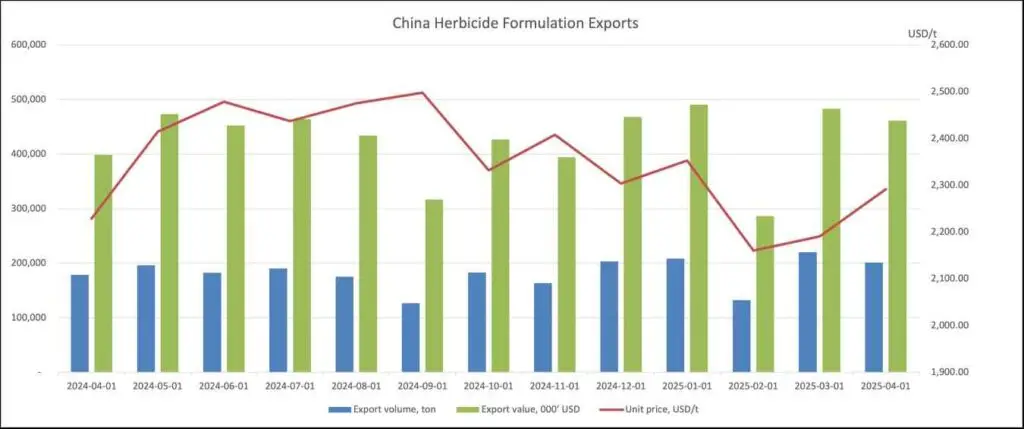

According to the General Administration of Customs of China (GACC), the country exported a total of 201,465 tons of herbicide formulations in April 2025, representing a 12.71% year-on-year (YoY) increase. Export value soared to US $461.67 million, reflecting a 15.88% YoY growth, while the average export price reached US $2,291.58 per ton, up 2.28% YoY.

This marks a resilient performance in the herbicide segment, signaling China’s enduring role in the global agrochemical supply chain.

Key Export Destinations in April 2025

China’s herbicide formulations reached 128 countries and regions. The top three importers by volume were:

Brazil

- Export volume: 32,972 tons (+158.98% YoY)

- Export value: Strong rise to +130.79% YoY

- Average export price: Dropped 13.49% YoY

Despite the price dip, Brazil remains a powerhouse market, with heavy herbicide consumption linked to expansive soybean and maize cultivation cycles.

Thailand

- Export volume: 14,970 tons (+9.30% YoY)

- Export value: +10.41% YoY

- Average export price: Slight gain of 0.99% YoY

Thailand showed moderate but steady growth in both volume and pricing, signaling a stable demand structure for herbicide inputs.

Nigeria

- Export volume: 11,342 tons (−12.42% YoY)

- Export value: Surprisingly up +3.72% YoY

- Average price: Up significantly at +18.56% YoY

Although volume dipped, the sharp price increase hints at either a shift to more advanced formulations or rising input costs for Nigerian buyers.

January–April 2025 Cumulative Export Summary

For the first four months of 2025, China exported 763,161 tons of herbicide formulations, with an accumulated export value of US $1.72 billion. The average price for this period stood at US $2,248.93 per ton.

This represents robust quarterly export performance, with seasonal spikes aligning with southern hemisphere planting cycles.

Market Trends and Analysis

1. Brazilian Boom, Cost-Conscious Market

Brazil’s nearly 159% volume growth comes despite a decline in per-ton prices, indicating bulk procurement of generic herbicides like glyphosate and 2,4-D. This aggressive import likely supports large-scale agricultural expansion and early-season planting needs.

2. Thailand’s Consistency

As a mature Southeast Asian market, Thailand continues its measured import pace with slightly higher prices, suggesting a preference for stable, mid-tier formulations.

3. Nigeria’s Premium Pivot

Nigeria’s reduced volumes but significantly higher pricing might reflect localized demand for specialty formulations or rising procurement costs amid fluctuating currency and regulatory pressures.

Strategic Implications for China’s Agrochemical Exporters

China’s dominance in the global herbicide trade rests on:

- Efficient manufacturing bases (e.g., Jiangsu, Shandong, Zhejiang)

- Large formulation variety, allowing export tailoring

- Competitive pricing despite raw material volatility

- Compliance with international MRL and residue standards

Key exporters like Nanjing Red Sun, Nutrichem, Zhejiang Wynca, and Rainbow Agro have led in volume due to vertically integrated production and favorable export logistics.

Export Outlook

With favorable climatic planting windows in Brazil and Southeast Asia, and increasing weed resistance driving demand for newer formulations, China’s herbicide exports are positioned to continue growth into Q2 and Q3 2025. However, exporters must monitor:

- Rising scrutiny over residue standards

- Price volatility in glyphosate and glufosinate raw materials

- Geopolitical and freight dynamics affecting delivery timelines

Summary: April 2025 Performance at a Glance

| Metric | April 2024 | April 2025 | YoY Change |

|---|---|---|---|

| Volume (tons) | ~178,600 | 201,465 | +12.71% |

| Value (US$) | ~$398.3 million | $461.67 million | +15.88% |

| Avg Price (US$/ton) | ~$2,240 | $2,291.58 | +2.28% |