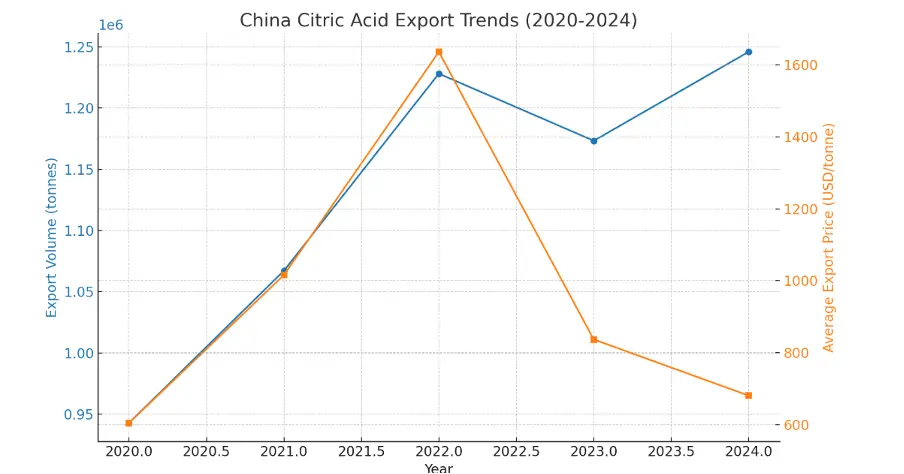

Over the past five years, China’s citric acid export volume has followed a fluctuating trend:

Between 2021 and 2022, exports surged significantly, driven by a decrease in foreign production and supply. After a slight dip in 2023, exports rebounded in 2024, although the average export price declined.

According to the General Administration of Customs of the People’s Republic of China (GACC), China exported 1,245,900 tonnes of citric acid in 2024, reflecting a 6.21% year-on-year (YoY) increase. However, the average export price dropped to USD 680.65 per tonne, marking an 18.72% YoY decrease.

Key Producing Region

East China is the primary export region for citric acid in China, with Shandong, Jiangsu, and Anhui being the leading provinces for citric acid exports in 2024.

· Shandong:

- Exported 1,037,800 tonnes, making up 83.29% of total citric acid exports in 2024.

- As the largest production hub, Shandong’s export share increased, with a slight 0.41% YoY increase in 2025.

· Jiangsu:

- Exported 86,800 tonnes, accounting for 6.96% of total exports, showing a 1.34% YoY decrease.

- The decline in exports is mainly attributed to a decrease in imports from India.

· Anhui:

- Exported 35,600 tonnes, contributing 2.86% to the total export volume.

- Experienced a marginal 0.02% YoY increase in exports.

Strong Partnership

Most countries in Aisa and Europe showed an increase in imports, contributing to an improved export outlook for China’s citric acid.

· India:

- Imported 131,700 tonnes, accounting for 10.57% of China’s total citric acid exports in 2024.

- Experienced a marginal 0.19% YoY decrease.

· Russia:

- Imported 80,400 tonnes, accounting for 6.46% of China’s total exports.

- Marked a 0.90% YoY increase in imports.

· Mexico:

- Imported 75,300 tonnes, representing 6.04% of China’s total exports.

- Saw a 0.87% YoY increase in imports.

2025 Outlook

By 2025, the average cost of corn—an essential ingredient in citric acid production—is expected to fall, leading to lower production costs and enhancing the global competitiveness of Chinese manufacturers. This will allow China to maintain its dominant position in both supply and pricing. However, the path ahead isn’t without obstacles. A sluggish global economic recovery and potential changes in trade policies across various regions could present risks to the market. While exports are forecasted to stay strong, a modest year-on-year dip of around 4.70% is anticipated for 2025.